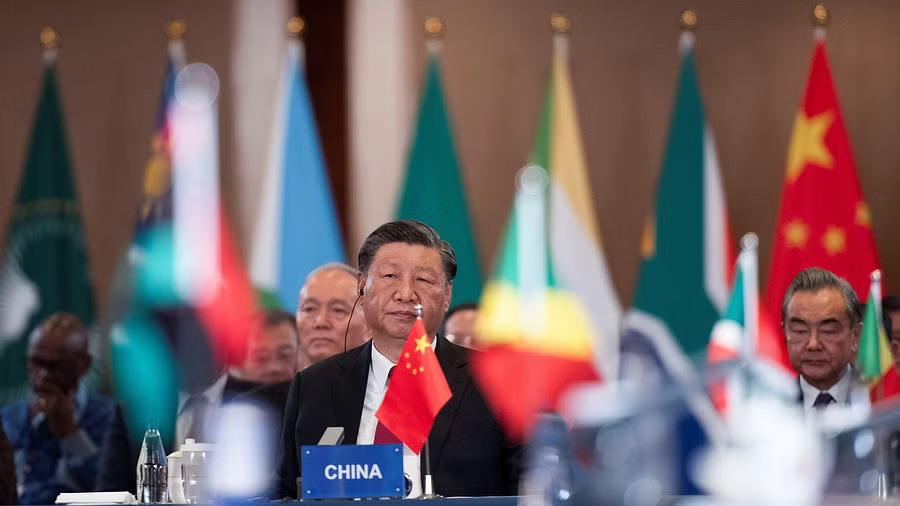

A recent opinion piece delves into the potential benefits that China could reap if the BRICS (Brazil, Russia, India, China, and South Africa) countries decide to conduct their trade transactions using local currencies. The analysis delves into the impact of such a move on China’s economic influence, trade relations, and its broader strategic objectives within the BRICS bloc.

The proposal to conduct trade among BRICS nations using their respective local currencies is seen as a step towards reducing dependency on the US dollar and fostering greater financial autonomy among member states. Such a shift could offer advantages to China, which boasts a robust economy and the yuan as a globally recognized currency.

“Shifting towards local currency trade within BRICS could align with China’s aspirations for an enhanced role in the global financial system and bolster its strategic position within the group,” noted [Economic Analyst’s Name], an expert in financial matters.

The opinion piece examines how China’s efforts to internationalize the yuan have been a cornerstone of its financial strategy in recent years. As the world’s second-largest economy, China seeks to lessen its reliance on the US dollar and establish the yuan as a credible alternative for international trade and finance.

“China’s economic stature and its efforts to promote the yuan’s global recognition could align with the BRICS initiative to trade in local currencies, creating a mutually beneficial arrangement,” commented [Global Trade Expert’s Name], an expert in international commerce.

However, the analysis also highlights potential challenges associated with implementing local currency trade within the BRICS bloc. The diversities in economic size, exchange rate stability, and monetary policies among member countries could pose hurdles to seamless currency transitions.

“Though the idea of local currency trade is appealing, the practicality of implementation requires careful consideration. Overcoming technical and policy challenges will be crucial for a successful transition,” emphasized Financial Diplomat in economic diplomacy.

As BRICS nations continue to explore avenues for enhancing their economic collaboration, the question of local currency trade remains a topic of interest. The opinion piece underscores the complex interplay of economic factors, strategic positioning, and broader geopolitical considerations that will shape the future direction of economic ties among these emerging economies.